All about Offshore Account

Table of Contents3 Easy Facts About Offshore Account DescribedThe Offshore Account PDFsThe smart Trick of Offshore Account That Nobody is Talking AboutThe Best Guide To Offshore Account

Two typical mistaken beliefs about overseas banking are that it is prohibited and also that it is just for the super-wealthy. Well, it's not fairly so. As an expat you can use overseas financial legitimately and also to your benefit. This guide will show you how. First of all, banking offshore in a country various other than the one in which you currently live is definitely lawful and legit.An offshore savings account is frequently used by those who have little faith in their regional financial industry or economic situation, those that live in a much less politically secure nation, those that can legitimately stay clear of taxes in their brand-new nation by not paying funds to it, as well as deportees who desire one centralised bank account resource for their international financial demands.

Keeping a savings account in a nation of abode makes considerable and long-lasting feeling for several expatriates. Unless you're trying to transform your nation of abode and sever all ties with your house nation permanently, retaining a banking visibility there will certainly indicate that if ever before you intend to repatriate, the course will be smoother for you.

For example, your employer might demand you have such an account right into which your salary can be paid monthly. You may likewise require such an account to have energies linked to your new home, to get a cellphone, rent out a home, elevate a mortgage or acquire a vehicle.

Excitement About Offshore Account

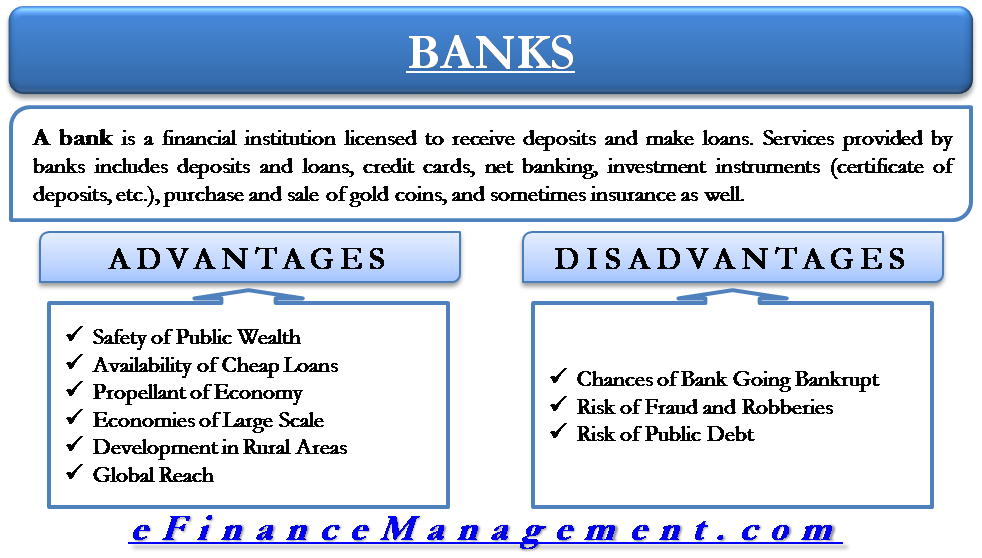

The main thing to bear in mind is that overseas financial isn't always an excellent remedy for every expat. It is essential to understand what advantages and also negative aspects offshore financial has and just how it fits in your personal circumstance. To help you choose whether an overseas savings account is right for you, below are the most famous benefits as well as drawbacks of overseas financial.

If the country in which you live has a less than good financial environment, by keeping your wide range in an offshore bank account you can stay clear of the threats in your new nation such as high rising cost of living, currency decrease or also a stroke of genius or war. For those deportees living in a Get the facts country where you only pay tax obligation accurate you remit into that nation, there is an apparent tax advantage to maintaining your cash in an overseas checking account.

Deportees can take advantage of this despite where they remain in the world as it can imply they can access their funds from Atm machines or online or over the phone at any moment of the day or night, no issue what the moment zone. Any type of interest made is typically paid devoid of the reduction of taxation.

The 8-Second Trick For Offshore Account

Note: professional estate preparation suggestions needs to be looked for by anyone looking for to gain from such a benefit. Some overseas banks charge less as well as some pay more rate of interest than onshore banks. This is becoming much less and also much less the situation nowadays, however it deserves looking closely at what's readily available when looking for to develop a brand-new overseas checking account. offshore account.

Less government intervention in overseas monetary centres can imply that overseas banks have the ability to use even more intriguing financial investment services and also options to their customers. You might profit from having a partnership supervisor or private checking account supervisor if you choose a premier or private offshore financial institution account. Such a solution is of benefit to those that want an browse around this site even more hands-on method to their account's administration from their bank.

and permit you to wait for a details rate prior to making the transfer. Historically banking offshore is perhaps riskier than banking onshore. This is shown when taking a look at the results from the Kaupthing Vocalist and Friedlander collapse on the Isle of Man. Those onshore in the UK who were impacted in your area by the nationalisation of the bank's parent company in Iceland got full payment.

The term 'offshore' has actually come to be synonymous with prohibited and also unethical money laundering and also tax evasion task. Therefore certainly anybody with an offshore savings account can be tarred, by some, with the very same brush although their offshore financial activity is entirely genuine (offshore account). You have to pick your offshore territory very carefully.

Some Ideas on Offshore Account You Should Know

It's essential to look at the terms and also conditions of an offshore financial institution account. It can be a lot more challenging to solve any kind of concerns that might emerge with your account if you hold it offshore.

And anonymous as well as complying with these durable criteria, deportees may still be able toenjoy more privacy from an offshore bank than they can from an onshore one. This factor alone is enough for many individuals to open an offshore financial institution account. There can be expat tax obligation benefits to making use of an overseas bank -but whether these use in your situation will certainly depend on your personal conditions, such as country of residence.